GST on Residential Property

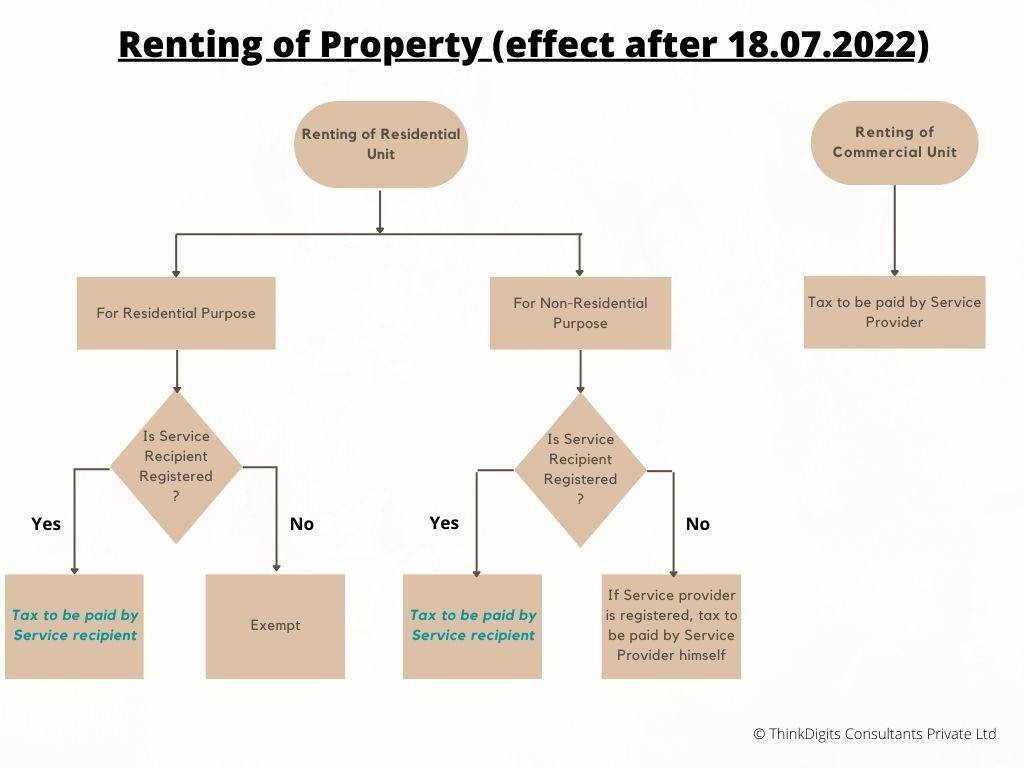

As per the new rules w.e.f. July 18, 2022, if the tenant of the residential property is GST-registered, he has to pay 18% GST irrespective of the fact that the landlord is GST-registered or not. The payment of the GST shall be made under the reverse charge mechanism (RCM), which means that the tenant shall directly pay the GST to the government.

Tenants who are GST registered must pay GST when renting a residential property. The tenants registered under GST may include companies; small businesses doing business in residential property; online content creators who shoot videos, etc.; and business professionals like CAs, lawyers, architects and business consultants.

The new rule will have an effect on GST-registered tenants. For example, if a company takes a guesthouse on rent or if a company takes a residential property on rent for the sake of its employees, then the company has to pay 18% GST. However, if the employee directly takes a resident takes a residential property on rent, he is not liable to pay GST.

Cases in which GST is not payable by Tenants:

- On Residential Property Tenants who are not GST registered are not required to pay GST when renting a residential property.

- The salaried class person is not required to pay GST when renting a residential property.

Related Articles

Common Services covered under RCM (Reverse Charge) under GST

S.No Type of Service Service Provider Service Recipient Description of Service 1. Goods Transport by Road (GTA) Goods Transport Agency (who has not opted for FCM option in 5% or 12%) Any person other than non business entity. Services provided by GTA ...GST Updates (July '22)

Central Board of Indirect Tax and Custom (CBIC) has released various notifications enforcing various recommendations of 47th GST Council meeting held on 29th June 2022 and related to E-invoicing. Applicable from 18.07.2022 RELATED TO GOODS Rates on ...Procedure to Pay GST Challan

For paying GST challan related to Returns or any demands, please follow below steps: Go to GST portal https://www.gst.gov.in/ Select 'Services' from Menu bar and then Select 'Payments'. You'll have following options: Create Challan: Click if you want ...GST on Pre-Labelled and Pre-packaged goods (GST Update 13.07.2022)

There are various misunderstanding as to levy of GST on common food products including wheat, rice etc. It is being said that this move by government will increase the price of essential commodities thus affecting common man. Various mandi have held ...Understanding GST on Goods Transport Agency (GTA) Services (from recipient perspective)

Change w.e.f 18.07.2022 Categories of transporters: A transporter who are GTA and not charging GST on Bills. A transporter who are GTA and charging 5% or 12% GST on Bills. A transporter who is not a GTA. GST Treatment for GTA, whether registered or ...